Homebuyers on a $3,000 monthly budget have gained nearly $40,000 in purchasing power since mortgage rates peaked last fall

Buyers can afford a more expensive home now that mortgage rates have dropped to 6.7%, down from nearly 8% in October. Local economists don’t expect rates to rise or decline significantly in the foreseeable future.

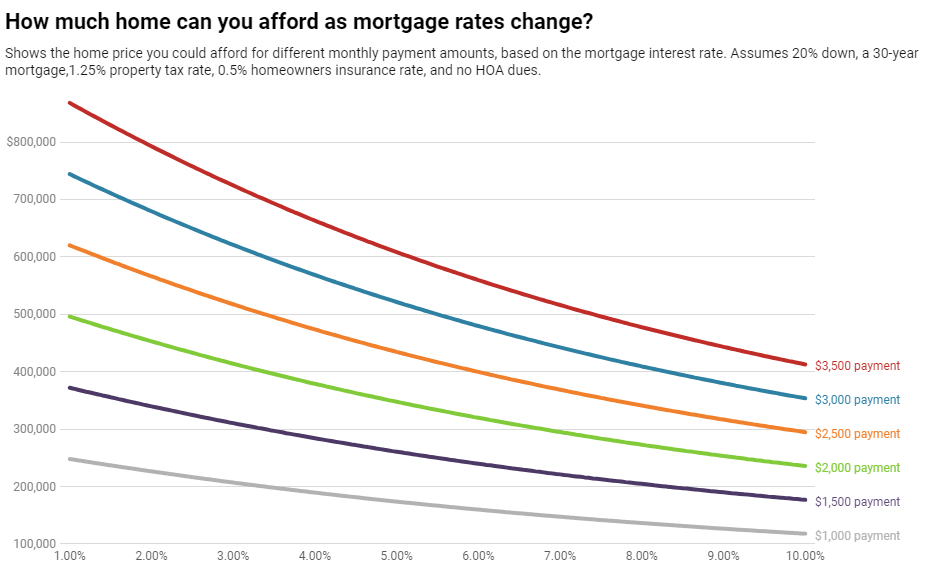

A homebuyer on a $3,000 monthly budget can afford a $453,000 home with a 6.75% mortgage rate, roughly this week’s average. That buyer has gained nearly $40,000 in purchasing power since October 2023, when they could have bought a $416,000 home with an average rate of 7.8%.

To look at affordability from another perspective, the monthly mortgage payment on the typical U.S. home, which costs roughly $363,000, is $2,545 with a 6.7% rate. The monthly payment was nearly $200 higher–$2,713–when rates were at 7.8%.

Homebuyers are getting some relief in 2024 as mortgage rates come down from the two-decade high they hit this past October. Weekly average rates dipped into the 6.6% range by the end of 2023 and ticked up slightly to 6.7% this week. While that’s double the record-low 3% rates buyers scored during the pandemic.

Mortgage rates likely to stay in the 6’s for the foreseeable future

National economists predict mortgage rates will end the year lower than they started, but the path is likely to be bumpy. We’re keeping an eye on next week’s Fed meeting to provide more clues on how soon they will cut interest rates: It could be as soon as March, but it’s likely to be later. Mortgage rates should come down a little–but not a lot–when interest rates are cut.

“My advice to serious house hunters: Trying to time the market around mortgage rates is probably a waste of energy, as affordability is unlikely to change meaningfully in the next several months,” said economist Daryl Fairweather “Instead, buyers should consider their own personal and financial circumstances: What matters most is whether the home meets your needs long term and whether you can afford it. Timing the market mattered in 2021, when we were in a golden window of record-low rates–but that window is closed.”