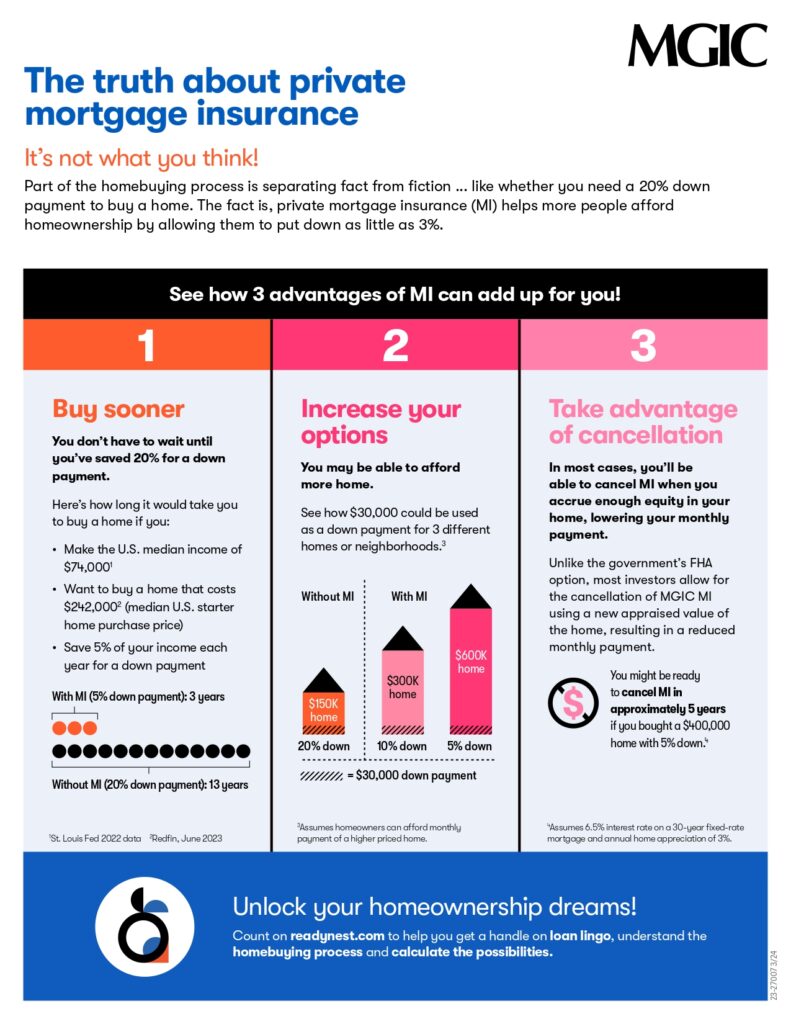

Navigating the intricacies of private mortgage insurance (MI) can be a daunting task for borrowers, but the benefits can really add up! They include:

· Increased buying power: Because MI makes it possible to buy a home with less than 20% down, homebuyers can reach savings goals faster and become homeowners sooner than otherwise possible.

· Expanded cash flow options: Borrowers can benefit by putting less money down and keeping cash for other uses, like making investments, paying off debt or paying for home improvements.

· Cancellable over time: In most cases, borrowers will be able to cancel MI when they accrue enough equity in their home, lowering their monthly payment.