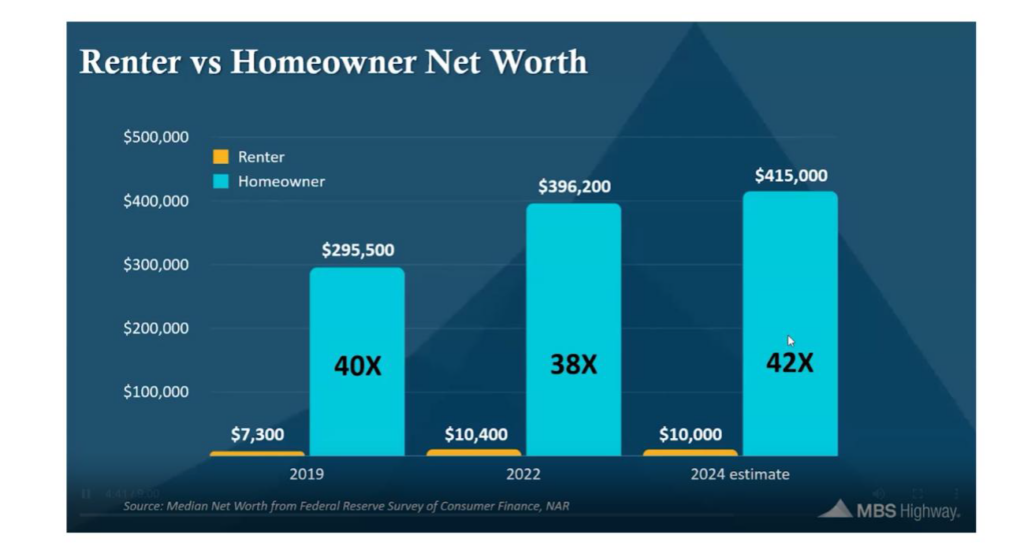

One of the best ways to build your family’s financial future is through homeownership. The Federal Reserve reports the net worth of a homeowner is actually over 40 times greater than that of a renter. Maybe it’s time to start thinking about buying a home, especially when they’re so affordable in today’s market.

Every three years Consumer Finances shows how owning a home helps build financial security. In the graph below, the average net worth of homeowners continues to grow, while the net worth of renters tends to hold steady and be significantly lower than that of homeowners. The gap between owning and renting just keeps getting wider over time, making homeownership more and more desirable for those who are ready.

The value of home equity is why Gallup reports that Americans choose real estate as the best long-term investment for 7 years in a row: 35% of Americans chose real estate over stocks, savings accounts, gold, and bonds.

If you’re ready, buying a home can set you up to increase your net worth and create a safety net for your family’s future.