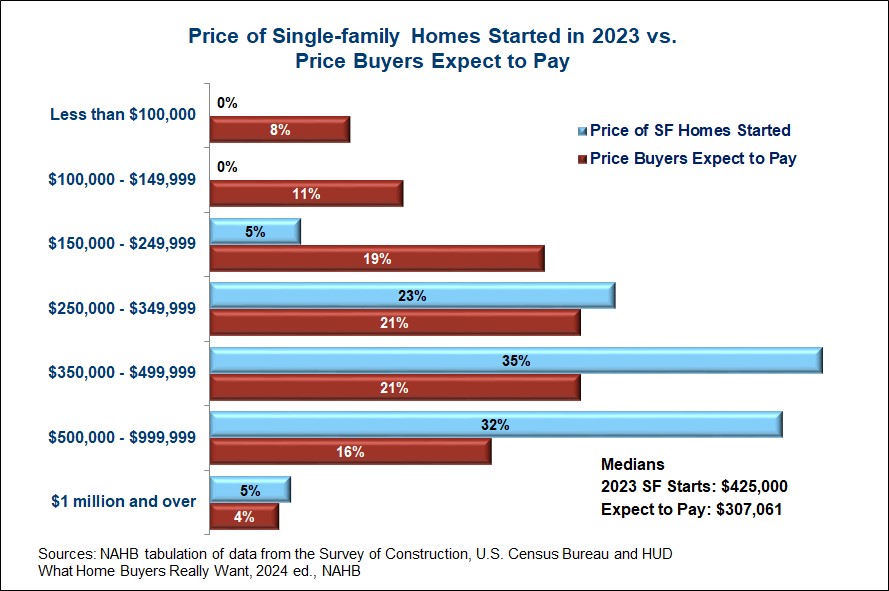

There is a mismatch between the prices of homes being built, and the prices home buyers expect to pay, according to recent surveys from NAHB and the U.S. Census Bureau. While 38% of buyers expect to pay less than $250,000 for their next home nationwide (and 19% expect to pay less than $150,000), only 5% of homes that started construction in 2023 are actually priced under $250,000 (and a negligible count are priced under $150,000).

Results from NAHB’s latest home buyer preference survey were published in the 2024 edition of What Home Buyers Really Want. The survey collected information from a representative sample of 3,008 recent as well as prospective home buyers during 2023, including the information on the price they expect to pay for their next home (or did pay if they purchased one recently). The median price they expected to pay was about $307,000. Only 20% expected to pay $500,000 or more.

In contrast, NAHB tabulation of recently released data from the Census Bureau’s Survey of Construction shows that the median price of single-family homes built for sale and started in 2023 was $425,000. The vast majority—95%—were priced at $250,000 or more. A substantial share, 37%, were priced at $500,000 or more.

There is an obvious pattern to the above chart. Below $250,000, the red bars are longer than the blue bars, indicating that the share of prospective and recent buyers exceeds the share of new homes being built in those price ranges. Above $250,000, the opposite is true. The blue bars are longer than the red bars, indicating that the share of homes being built exceeds the share of buyers in the market at those prices. The difference is especially stark at prices below $150,000, where 19% of buyers are shopping for a home and almost no homes are being built.

Part of the explanation may be that the lower end of the market is differentially served by existing homes. However, there are limits to how well existing homes can satisfy the demands of prospective buyers with modest incomes. As previous posts have noted, the supply of existing homes has been running at historically low levels for several years and prices of existing homes have been setting record highs. Indeed, the median price of an existing home in May was well over $400,000.

Another large part of the explanation for the actual vs. expected price mismatch is the cost of new home construction. Builders know that a potential market exists for new homes priced under $150,000; they just can’t build homes at such a low cost.

All the inputs to residential construction interact to raise the cost of new home construction. Residential construction wages continue to rise. Although prices of many residential building materials have been stable recently, the stability comes after massive increases in the two years following the onset of the COVID pandemic. A shortage of lots has been a chronic issue since the home building industry started to recover from the Great Recession.

Moreover, regulatory costs can be substantial. NAHB’s latest study on the topic shows regulation accounting for $93,870 of the cost of an average new single-family home. The largest regulatory cost impact, $24,414, comes from changes to building codes over the past 10 years. This is followed by $12,184 in fees paid by the builder after purchasing the lot, $11,791 in regulatory costs incurred by the developer during site work, $10,854 in the value of land that must be purchased and dedicated to the government or otherwise left unbuilt, and $10,794 in required architectural details that exceed what the builder would ordinarily do.