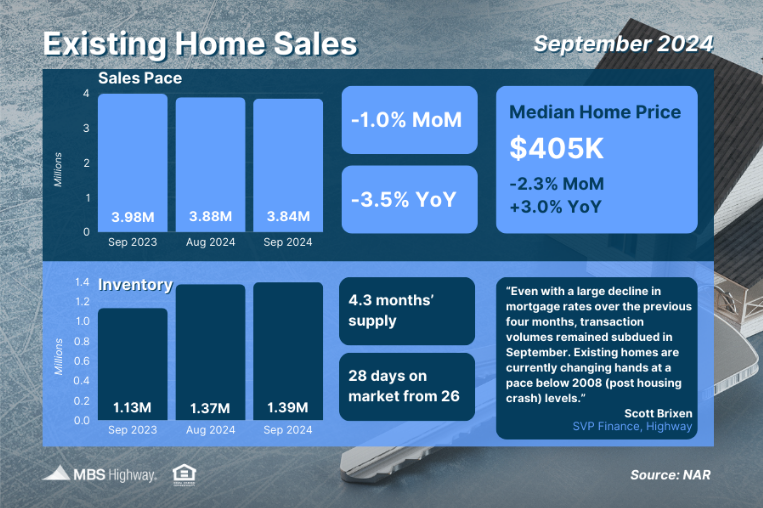

Existing Home Sales, which reflect closings on existing homes, fell for the second

straight month in September, down 1% from August and 3.5% from a year ago. The

3.84-million-unit pace represents a 14-year low as NAR’s Chief Economist, Lawrence

Yun, noted that “home sales have been essentially stuck at around a four-million-unit

pace for the past 12 months.”

Regarding inventory, there were 1.39 million homes available for sale at the end of

September, up 1.5% from August and 23% from a year earlier. While this sounds like a

big jump, the rise is from very low numbers and inventory remains well below pre-

pandemic levels.

Plus, many homes counted in existing inventory are under contract and not truly

available for purchase, meaning inventory is even tighter than the reporting implies. In

fact, there were only 941,000 “active listings” at the end of last month.

What’s the bottom line? While the number of closings declined in September, some of

the internals within the report point to buyer demand.

Homes remained on the market for an average of 28 days in September, and while

that’s an increase from 26 days in August, it’s still a relatively short period of time. In

addition, 20% of homes sold above list price, showing that there are still bidding wars in

about a fifth of sales nationwide. Plus, competition is expected to rise when rates move

lower.

All in all, the pent-up demand for homes combined with ongoing tight supply continues

to bode well for housing as an investment and continued home price appreciation over

time.